When it comes to budgeting, many people believe in the “old school” way of sticking to a simple sheet of paper. However, if you are looking for something more efficient and interactive then pie chart creator could be your best option!

Here are 10 tips for using a monthly pie chart maker for your financial management:

1. Prepare all of your monthly bills and gather them in one place

One of the most important things to do is to gather all of your statement statements in one place. Make sure that you have paper bills or online statements, wills, deeds, mortgage information, etc. All of these should be kept in an organized manner so that you will be able to produce a good chart.

2. Prepare all of your income information for your pie chart creator

Prepare all of the allowances that you receive every month, such as salary, child support, alimony, allowance, disability benefits, and government grants. It is important to gather this in one place so that it can be organized when creating your pie chart for better results.

3. Analyze your income and expenses in the circle chart

When creating a budget in a pie chart format, it is better to have a clear picture of the “whole picture” first, which means that you’ll have to analyze both your income and expenses regularly. If you do not know how much money you make each month and how much you spend, then you won’t be able to know what your savings should be. Pie chart creator apps are now available online which will give you the perfect solution for this.

Venngage

4. Set up a dedicated savings account (and forget about it!)

One of the best ways to increase your monthly savings is by setting up an automatic transfer to a savings account. This will prevent you from being tempted to spend your money on unnecessary things and help you build up a savings account easily. Then, when the month is over and you start to use your monthly budget template (which can also be created using a pie chart maker), everything will fall into place.

5. Invest in yourself

When it comes to increasing your income, there is always an opportunity cost which means that every time you spend money on something, you lose the potential to invest it. Some of the best ways to invest in yourself are by going back to school and acquiring new skills, thus increasing your qualifications and earning ability. Investing in a new car is not recommended because you cannot trade cars for cash if there are problems with them later on.

6. Keep track of all transactions for the pie graph

To know how much money you can spend every month, you need to keep track of all the transactions that you make regularly. Even if these are small purchases, it is important to diligently record them because even small expenses can add up after some time. Plus, this will help you discover unnecessary spending habits which should be cut out (i.e. smoking, gambling).

Venngage

7. Write all of your monthly bills and expenses on a sticker paper

One of the most effective ways to track your income and expenses daily is by writing them on stickers or labels and then sticking them on an envelope for easy reference. This will allow you to readily know how much money you will have every month and also help you see your spending habits.

8. Prepare a layout for all of your income and expenses on your pie chart generator

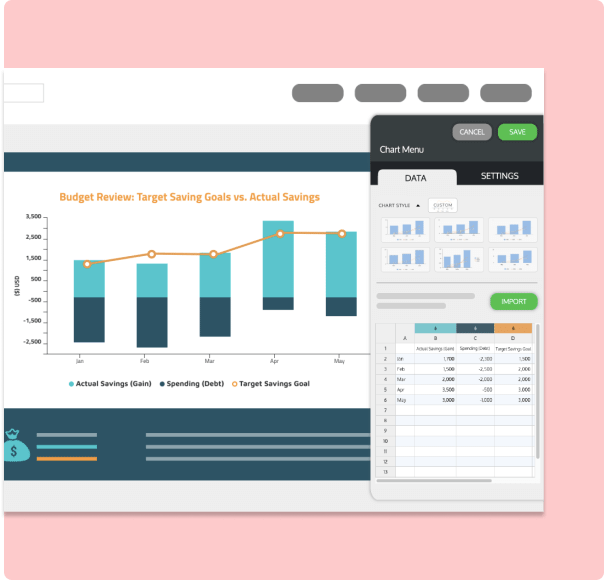

To create a good budget template, you should prepare a layout for each of your income and expenses. This will make the process easier because you can include as many details as possible so that there are no problems later on. If you want to be precise, then you should use a pie chart maker or budget template. Aside from pie charts, you may also use supplementary charts that can help you visualize your financial status. Check out the Venngage graph maker on their website.

9. Determine your net income (take-home pay)

Your net earnings are the total amount of money that is left after subtracting all of your monthly expenditures from your monthly income. You can determine this number through a pie chart or budget app, which will make your job easy and stress-free because everything will fall into place.

10. Make a pie chart for your monthly budget (and stick to it!)

The last step is to create your budget template using a pie chart maker. This will set the tone for all of your planning and allow you to accurately arrange each of your income and expenses in chronological order, which means that there will be no problems later on.

Get noticed online with fast-approved guest post websites Niche-targeted placements that improve your SEO rankings, increase organic traffic, and build your brand’s visibility for faster success.

In A Nutshell

Creating a monthly budget template using a pie chart maker is one of the best ways to get organized and ensure that everything falls into place on time. All you have to do is use your personal computer or phone, which will allow you to create a financial plan within minutes. Who knows, this may also help you save money in the long run.